Bright | September 2nd, 2020

TLDR: 5 paying customers on Bright Pass, Thomson Reuters completed trial, iOS and Android mobile apps are launched, graduated the Brandery accelerator.

Including today, it’s been 58 days since we’ve rebranded Cribcut to Bright and launched an entirely new product called The Bright Pass. Yesterday (Sept 1) marks the end of our beta period and our official public launch!

It’s been a busy time since July 7th. Here’s what we’ve accomplished in less than two months:

1. What is Bright?

Bright offers a combination of on-site and virtual services that help engage all types of employees and team members of the workplace. On-site offerings include hair, nails, dry cleaning, and massage. Virtual services include mindfulness, nutrition, yoga, and various fitness classes. Bright meets you where you are, delivering bold ambition and relentless dedication to getting more life done at work.

2. Traction:

We’ve signed up five paying customers during beta; all of whom paid for plans starting September 1st and received early access to Bright Pass from the time they made their first payment. Paying customers include:

(a) Totes Isotoner: 400-person fashion and apparel company based in Cincinnati

(b) UberFlip: 150-person software company in Toronto

(c) Rose Collective: a 50-tenant commercial office building in Minneapolis

(d) Equitable Bank: 800 person bank in Toronto (committed to a one-year subscription)

(e) Gener8tor: 50-person investment team spread across the Midwest

Total MRR as of today is $1,700 USD and we have access to close to 1500 employees within our 5 companies. This is not where we wanted to be with revenue, but looking back, what we’ve learned related to product, sales cycle, and engagement will allow us to grow more quickly going forward and build a better experience.

In addition to paid customers, we have a larger (currently unpaid) pilot project complete with Thomson Reuters; who is considering rolling out Bright Pass to over 7,000 employees across three offices. They wrapped up a 2-week trial wherein 25 employees participated in 277 classes (73 Nutrition, 51 Fitness, 50 Mindfulness, 31 Yoga, and 21 Keynotes). We also have a dozen other companies currently in free trials who are evaluating rolling out Bright Pass at their organizations (ranging from 100 to 8000 employees).

While on-site services continue to slowly come back, they are less of a focus for us right now as most companies are still working remotely. We do have 15 visits scheduled in the month of September (predicted revenue of $3750).

3. Content

We’ve hired a total of 10 facilitators (mix of FT, PT, & contractors) to teach Bright classes. Currently, we are running ~38 classes per day (~1000 per month) and when we hit our revenue targets (more below) we will be hosting over 3,000 live classes every month.

Why do we own/host all of the content instead of outsourcing it?

(a) Because our classes are live: most competitors only offer pre-recorded classes. One of the main values of a virtual well-being program for companies is to help engage employees while working from home. With recorded classes, this is next to impossible. With live classes, teammates can engage with each other, engage with their instructor, and receive a personalized experience in small class sizes. We are also beta-testing “challenges” to further drive engagement and provide value to companies and their teams.

(b) Because we want to control the experience: just like on-site services, the experience we deliver to employees (even though their employer is paying for Bright) is of the utmost importance. Our ability to control the Bright experience (content, visuals, technology, etc) is much easier with committed employees instead of contractors who are only half bought in. Employees also allow for us to provide a guaranteed content schedule, which is important to our users.

4. Engagement

As we’re still very early with respect to measuring Bright Pass engagement, we’re remaining cautious about drawing too many conclusions (good or bad) about what we’ve seen. With that said, here are a few key observations and metrics thus far.

(a) At 10:00 AM on September 2, we officially delivered our 100,000th minute of programming (about 1,670 hours).

(b) We have implemented a well-being intake form when a new member signs up. This gives us a baseline against which we can measure any changes over time (our assumption, of course, is that their state of well-being will improve as they use their Bright Pass).

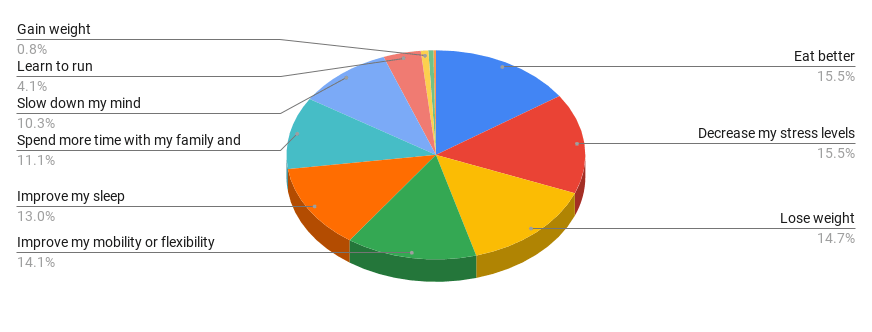

(c) The top three goals people have stated when signing up have been Eat Better (54), Decrease Stress Levels (54), and Lose Weight (52). See the below chart for all responses.

(d) We have built out an onboarding flow for new members that will send them a different sequence of seven emails (one per day for the first seven days) depending on what their goals are. This only launched on August 28th, but we’re already seeing people are finding their way to the most relevant content faster (which is a big deal when you have 1,000 classes a month to choose from). Here is an example of the types of emails we’d send to someone who noted that their goal with Bright was to lose weight.

(e) We’ve had 258 unique users attend at least one session (and an average of 10.2 sessions each) and the first 200 reviews have come in with an average star rating of 4.96 out of 5.

5. Technology

In order to launch Bright Pass, we needed to undertake a significant technical effort. Our small team of two full-stack developers, led by Kiran, has been able to accomplish the following in a short time frame:

(a) Create a scheduling, booking, and review system for virtual classes

(b) Integrated Zoom into our systems for hosting online sessions

(c) Launched iOS and Android mobile apps

(d) Designed and implemented per-partner security to ensure only eligible employees can access sessions

Of course, our roadmap is long, but I’m proud of our development team for pushing hard and launching all of the above.

6. Lessons Learned

(a) The core problems we’re solving for companies are employee stress/mental health challenges and low co-worker engagement. Both problems have been highlighted due to a full transition to remote-work, and Bright is extremely well-positioned to solve these challenges.

(b) The sales cycle is longer compared to on-site services (and what we expected). With on-site services, we typically proposed a free trial to start, and then a relatively low financial commitment after that ($0 (employee paid)-$400/month). With our virtual services, most of our proposals are $1,000+ per month (and currently go as high as $9,000/month). While obvious looking back, the sales cycle is looking more like 1-2 months instead of 1-2 weeks. This is not a bad thing due to a higher ACV but we do need to adjust our projections to this reality.

(c) Our team is one of the scrappiest and grittiest around: including service providers, we are 18 full and part-time employees. I am extremely proud of and grateful for our team to have accomplished everything above in less than two months. We now have our foundation built and the next two months which will surely be exciting.

7. What’s Next?

We set aggressive revenue goals and learned lessons because of it. The evidence we had early on led us to spend most of our time on a few very big deals; and while they are all still on the table and active, the sales cycle has been much longer than anticipated. The deals we have closed are smaller deals which have been very low effort. We have already made the adjustment to diversify our attention across big and small, and expect to cross $10k in MRR around mid-September. With that said, we have updated and set new targets for the rest of the year.

Here is an overview of what our team wants to accomplish in the new few months:

October 1st

(a) $10,000 USD MRR

(b) Validation/decision on launching a recorded library of classes as an add-on service (vs. 100% live classes)

November 1st

(a) $20,000 USD MRR

(b) 3,000 active classes

December 1st

(a) $40,000 USD MRR

8. Fundraising

With our recent graduation from the Brandery accelerator and the completion of over 75 investor meetings the past 4 weeks, we have officially opened up a $1.5M USD seed round. We are in early talks with several investors and will have another update on this next shareholder update (target October 1).